Looking for something similar?

LET’S TALK ABOUT IT!

NEED

Manage the setup of a strategy to handle the company credit risk, facilitating the consultation and monitoring of the commercial exposure and credit collection activities.

BENEFITS

In a unique platform, we’ve focused on the skills of the main actors of the credit collection life cycle, divided into specific functionalities to answer any critical issue.

THE NEW PLATFORM FOR CREDIT MANAGEMENT

In a company, commercial credit management is an administrative task that usually requires interaction with clients and a number of different professionals, which you rely on to follow up on outstanding bills.

Minimizing the time spent on the phone and meetings by administrative accountants could make credit collection a slimmer and quicker activity.

Facilitating the commercial exposure status monitoring and consultation could allow for better clarity and organizational capacity by the operators.

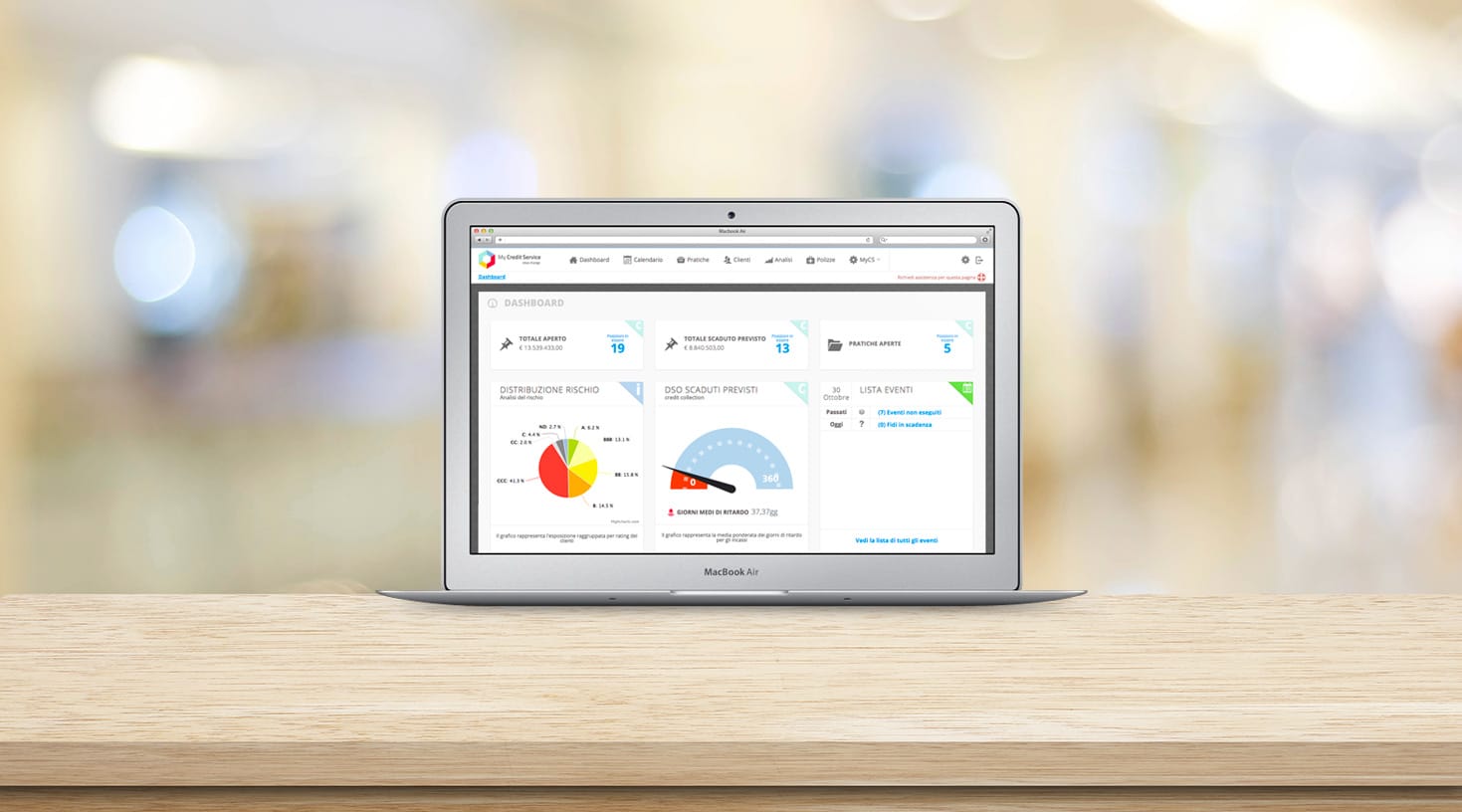

THE PLATFORM

This digital platform provides a clear outline of the outstanding bills situation in order to allow monitoring and facilitate collection activities.

Thanks to its technology it has been possible to make a portal that transformed competencies of three different roles into a single technological solution.

The three roles involved in the definition of an effective strategy of credit risk management are the commercial informatives’ suppliers, external commercial credit managers, and internal operators assigned to collect credit.

MyCreditService simplified the approach to credit management.

This platform has represented, not only a technological product but also a business model that provided an innovative startup, Credit Service, a number of clients in manufacturing and services in northern and central Italy.

Interlogica, after Credit Service, started to set up more companies making use of the same technology to explore new and interesting businesses.